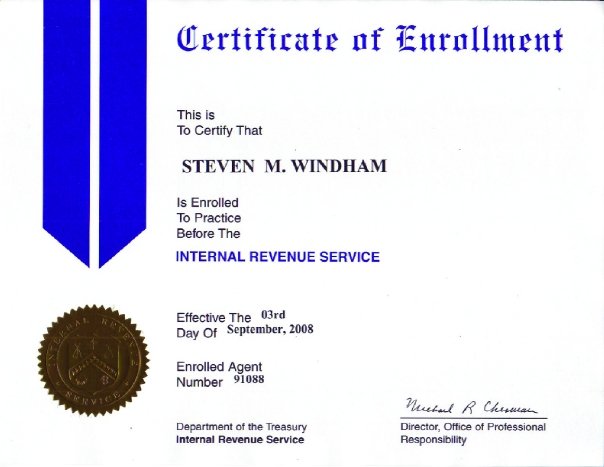

An Enrolled Agent is a credential awarded by the US Treasury/Internal Revenue Service that allows the credential holder to represent taxpayers before the Internal Revenue Service. The Enrolled Agent credential is the highest credential that the Internal Revenue Service Awards. For more information about the Enrolled Agent credential, please click here: https://www.irs.gov/tax-professionals/enrolled-agents

I strongly urge all of my accounting students to obtain their Enrolled Agent credentials. While the exam is rigorous, it is manageable. The exam is divided into three parts: 1) Individuals, 2) Businesses, and 3) Representation, Practices and Procedure. Section 2--Businesses, is by far the most difficult section.

My recommendation is to use the Gleim Enrolled Agent Review Course. This is the study course that I used for my Enrolled Agent exam, and I also plan to use Gleim for the CPA and CMA exams. Here is a link to the Gleim Enrolled Agent Review Courses: https://www.gleim.com/enrolled-agent-review/courses/

My recommendation is to purchase either the Traditional or Premium review systems.

.

.