Updated on Sunday, December 08, 2024.

Author: Steve M. Windham, LLM, MBA, EA

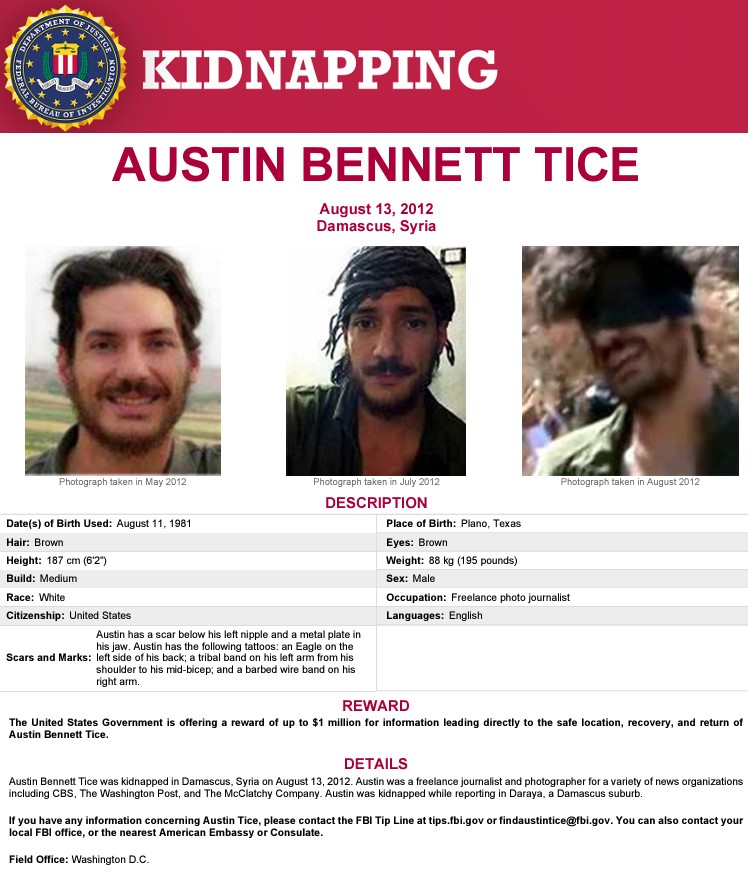

Support Press Freedoms

Updated on Sunday, December 08, 2024.

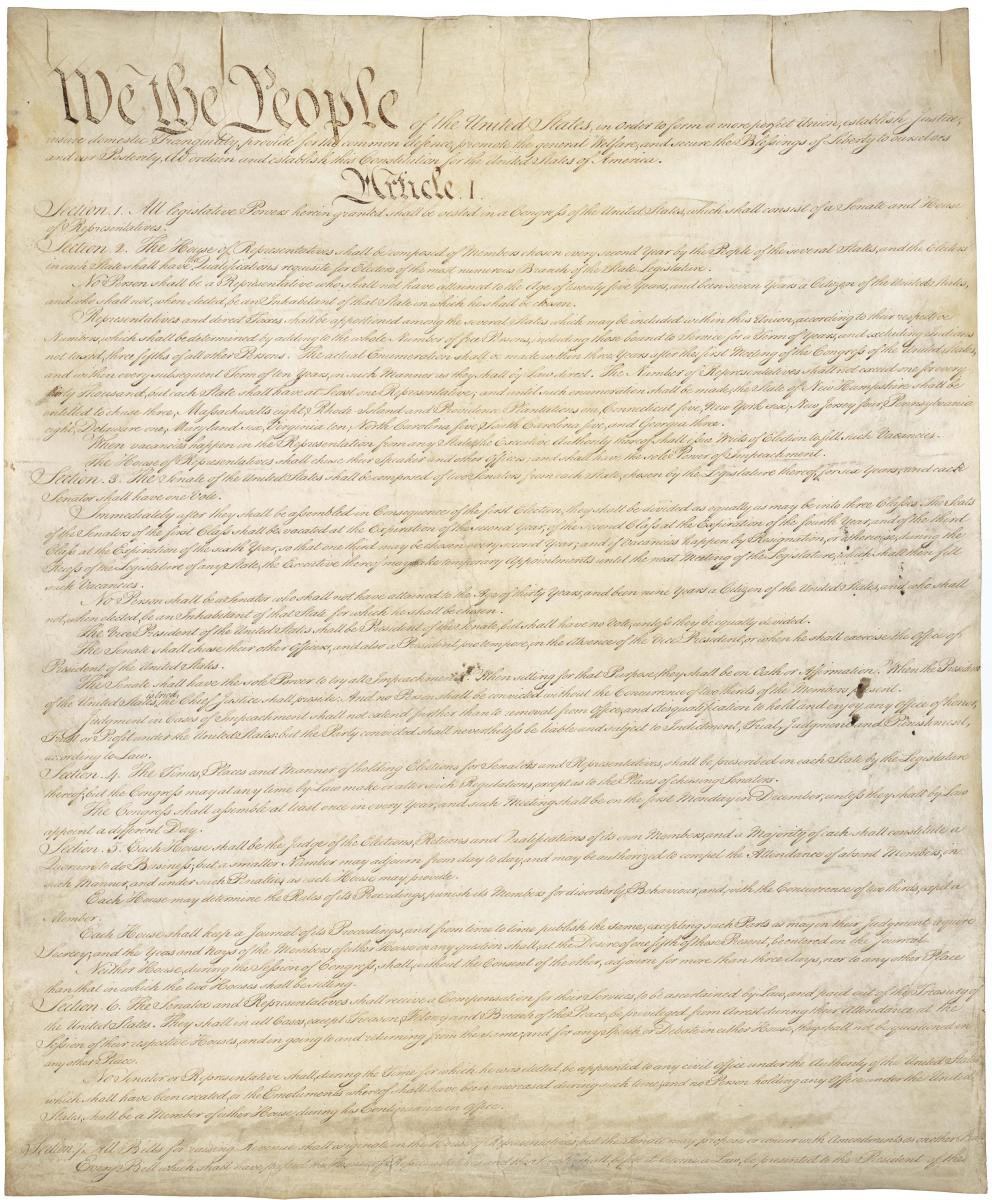

United States Constitution

Amendment I

Congress shall make no law respecting an establishment of religion, or prohibiting the free exercise thereof; or abridging the freedom of speech, or of the press; or the right of the people peaceably to assemble, and to petition the government for a redress of grievances.

The Universal Declaration of Human Rights

Article 18

Everyone has the right to freedom of thought, conscience and religion; this right includes freedom to change his religion or belief, and freedom, either alone or in community with others and in public or private, to manifest his religion or belief in teaching, practice, worship and observance.

Article 19

Everyone has the right to freedom of opinion and expression; this right includes freedom to hold opinions without interference and to seek, receive and impart information and ideas through any media and regardless of frontiers.

Article 20

1. Everyone has the right to freedom of peaceful assembly and association.

2. No one may be compelled to belong to an association.

Press Freedom Organizations

Bring them home!

Journalists Freed

Nike: Find Your Greatness

Nike

Truth be told, I have not been a very big fan of Nike for many years. This has been primarily due to their business practices where their endorsements pay a single athlete more than the entire annual payroll of a Southeast Asian manufacturing facility. For example, Tiger Woods, over a course of 27 years, has been paid approximately US$500 million by Nike. See: https://golf.com/news/how-much-nike-contributed-tiger-woods-fortune/

Conversely, Nike's factory employees in Southeast Asia are typically paid about US$3.50 per day, and they are often not paid the agreed upon wages. See: https://cleanclothes.org/news/2023/nike-board-executives-under-fire and https://www.maquilasolidarity.org/en/nike-and-ramatex-should-pay-workers-in-cambodia.

There are some valid reasons for low pay in these countries. Imagine the chaos if Nike and other Western companies paid US/EU wages in a region where few people make US/EU minimum wages. For reference, the Federal minimum wage in the US is $7.25/hour. See: https://www.dol.gov/general/topic/wages/minimumwage. In Europe, the minimum wage varies greatly, but even the lowest minimum wages are higher than what the average Southeast Asian factory pays Nike workers. See: https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Minimum_wage_statistics.

Keep in mind that an MD in Vietnam makes approximately US$46,000/year. See: https://www.erieri.com/salary/job/medical-doctor/vietnam. In California, a full-time fast food worker can make almost this much (~US$40,000), as the minimum wage for fast food workers in California is $20.00/hour. See: https://www.gov.ca.gov/ The California basic minimum wage is $16.00/hour. See: https://www.dir.ca.gov/dlse/faq_minimumwage.htm.

An entire book can be written on the business ethics of Western companies and the amounts they pay to their Southeast Asian factory workers. Keep in mind, that many electronics and other goods are manufactured in Southeast Asian countries for extremely low rates of pay.

The point of my post is this: Nike made an incredible advertisement with their "Find Your Greatness" advertising campaign! It can be viewed here: Nike: Find Your Greatness (youtube.com)

Unfortunately, Nike still needs to find their greatness in paying their apparel workers an adequate wage in a safe working environment.

For more information, please visit:

https://www.maquilasolidarity.org/en/nike-and-ramatex-should-pay-workers-in-cambodia

Tax News — Week of 23 June 2024

United States

California

The California Supreme Court has ruled that the "Taxpayer Protection Act" must be removed from the ballot, as it would be a revision to California's Constitution. This would require an amendment, rather than an initiative.

https://lao.ca.gov/BallotAnalysis/Initiative/2021-042

Africa

Kenya

Passage of the 2024 Finance Bill has resulted in protest that turned violent, with several protesters killed and injured by the police.

https://www.voanews.com/a/several-shot-protesters-storm-kenya-s-parliament-after-lawmakers-approve-tax-hikes/7674258.html

Europe

Denmark

Starting in 2030, in Denmark, cows and pigs will be taxed for their contribution to producing greenhouse gases.

https://learningenglish.voanews.com/a/cows-pigs-face-carbon-tax-in-denmark/7674742.html

Gaza Protests (UC Davis & UC Berkeley)

Updated on Saturday, February 15, 2025.

On January 30, 2025, President Donald J. Trump signed an Executive Order to, "Combat Anti-Semitism." This Executive Order reads in part:

- Deport Hamas Sympathizers and Revoke Student Visas: “To all the resident aliens who joined in the pro-jihadist protests, we put you on notice: come 2025, we will find you, and we will deport you. I will also quickly cancel the student visas of all Hamas sympathizers on college campuses, which have been infested with radicalism like never before.”

While I understand that many people will scream that this is violative of the First Amendment, they need to be reminded that the protections afforded by the First Amendment are not absolute. Many of these protesters have crossed the line from protesting to criminal activity. And, many protesters have also engaged in speech that is not protected, such as: true threats, incitement, fighting words, and harassment. In short, these protesters (as a whole) have behaved so poorly that I applaud President Trump's Executive Order to curb their behavior.

-------

For more than a month now, people have been protesting the war in Gaza, with most of these protests having been on university campuses. I have had the opportunity to photograph these protests on two University of California campuses -- Davis and Berkeley.

While I am a staunch supporter of the First Amendment, many of these folks have taken it way beyond what is protected speech. Assault, battery, trespassing, burglary, vandalism, violating campus policies (disrupting graduations, disrupting classes, disrupting exam weeks, blocking bus stops, illegal camping, etc.) have crossed the line from protected speech to criminal activity.

While photographing the protest at UC Davis, I was hit with an umbrella, had many other umbrellas, hands, and other objects shoved in my face and in front of my camera. I had one "security" guard (who happened to be an unlicensed security guard) shine a bright light into my eyes. They tried to harass and intimidate me by following me in a public place. The whole ordeal has left me with a very negative view of these protesters. Most of them have covered their faces because they know they are committing crimes and violating campus rules. In short, they are scofflaws who cowardly hide behind masks and fences; many of them are completely ignorant as to what and why they are protesting.

The website CANARY MISSION has created a database of many of these dangerous individuals. Click here to visit CANARY MISSION's searchable website.

Follow the link for more photos.

https://www.stevewindham.com/portfolio/photojournalism/gaza-protests/

Happy Eclipse Day (2024, April 08)

Happy Eclipse Day from Vacaville, California!

An eclipse is a type of astronomical syzygy,

where three or more celestial bodies align in roughly a straight-line.

Equipment and Technique:

Canon 7D with a Canon zoom lens EF-S 18-135mm 1:3.5-5.56 IS set at 135mm.

The lens was covered with a solar camera lens filter.

Hand-held. Only post-production was cropping.

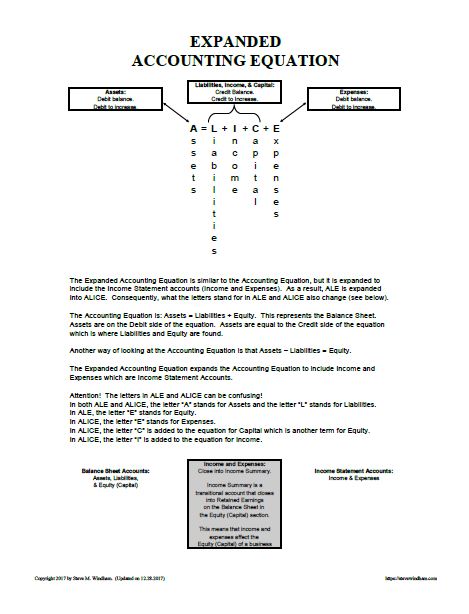

Protected: Accounting I Class Starts Wednesday, August 23, 2023.

June is National PTSD Awareness Month & Men’s Health Month

May is National Mental Health Awareness Month.

Click here for more information.

June is National PTSD Awareness Month.

Click here for more information.

June is Men's Health Month.

Click here for more information.

July is National Minority Mental Health Awareness Month.

Click here for more information.

If you are experiencing a mental health crisis, please call someone!

If you live in the United States and are experiencing a mental health crisis, you can call or text 988.

This line is staffed 24/7, and is available in English and Spanish.

You can also call 911 for immediate response from local first responders (typically EMT / Paramedics, Fire, and / or Highway Patrol / Police / Sheriff). Please note that you may or may not receive assistance from someone with adequate crisis intervention training when you call 911. Police are often known to escalate the situation. While there is a growing movement for police agencies to partner with mental health professionals, many police are simply not qualified to engage in mental health crises.

Depending on your situation and location, you may wish to check yourself into the Emergency Room of your local hospital.

If you are a student, you may wish to speak with your school counselor, teacher / professor, or administrator.

You may also want to reach out to a local church or other place of worship. Many religious institutions offer free, or low-cost, faith-based counseling.

You may also consider reach out to a trusted friend or family member.

Please call someone if you are having a mental health crisis!

Resources:

- 988 Suicide & Crisis Lifeline

- CalHOPE

- National Alliance on Mental Health (NAMI)

- NeedEncouragement.com (Free Christian Counseling)

- U.S. Department of Health & Human Services; Substance Abuse and Mental Health Services Administration (SAMHSA)

- United States Department of Veteran Affairs, Mental Health

If you live outside of the United States, please see the chart below for help in your area.

| Country | Hotline organization | Website | Phone number |

|---|---|---|---|

| Argentina | Centro de Asistencia al Suicida | www.asistenciaalsuicida.org | (011) 5275-1135 |

| Australia | Lifeline Australia | www.lifeline.org | 13 11 14 |

| Austria | TelefonSeelsorge Österreich | www.telefonseelsorge.at | 142 |

| Belgium | Centre de Prévention du Suicide | www.preventionsuicide.be | 0800 32 123 |

| Belgium | CHS Helpline | www.chsbelgium.org | 02 648 40 14 |

| Belgium | Zelfmoord 1813 | www.zelfmoord1813.be | 1813 |

| Brazil | Centro de Valorização da Vida | www.cvv.org | 188 |

| Canada | Crisis Services Canada | crisisservicescanada.ca | 833-456-4566 |

| Chile | Ministry of Health of Chile | www.hospitaldigital.gob | 6003607777 |

| China | Beijing Suicide Research and Prevention Center | www.crisis.org | 800-810-1117 |

| Costa Rica | Colegio de Profesionales en Psicología de Costa Rica | psicologiacr.com/aqui-estoy | 2272-3774 |

| France | SOS Amitié | www.sos-amitie.org | 09 72 39 40 50 |

| Germany | TelefonSeelsorge Deutschland | www.telefonseelsorge.de | 0800 1110111 |

| Hong Kong | Suicide Prevention Services | www.sps.org | 2382 0000 |

| India | iCall Helpline | icallhelpline.org | 9152987821 |

| Ireland | Samaritans Ireland | www.samaritans.org/how-we-can-help | 116 123 |

| Israel | [Eran] ער"ן | www.eran.org | 1201 |

| Italy | Samaritans Onlus | www.samaritansonlus.org | 06 77208977 |

| Japan | Ministry of Education, Culture, Sports, Science and Technology | www.mext.go.jp | 81-0120-0-78310 |

| Japan | Ministry of Health, Labour and Welfare of Japan | www.mhlw.go | 0570-064-556 |

| Malaysia | Befrienders KL | www.befrienders.org | 03-76272929 |

| Netherlands | 113Online | www.113.nl | 0800-0113 |

| New Zealand | Lifeline Aotearoa Incorporated | www.lifeline.org | 0800 543 354 |

| Norway | Mental Helse | mentalhelse.no | 116 123 |

| Pakistan | Umang Pakistan | www.umang.com.pk/ | 0311-7786264 |

| Peru | Linea 113 Salud | www.gob.pe/555-recibir-informacion-y-orientacion-en-salud | 113 |

| Philippines | Department of Health - Republic of the Philippines | doh.gov.ph/NCMH-Crisis-Hotline | 0966-351-4518 |

| Portugal | SOS Voz Amiga | www.sosvozamiga.org | 213 544 545

963 524 660 912 802 669 |

| Russia | Фонд поддержки детей, находящихся в трудной жизненной ситуации [Fund to Support Children in Difficult Life Situations] |

www.ya-roditel.ru | 8-800-2000-122 |

| Singapore | Samaritans of Singapore | www.sos.org | 1-767 |

| South Africa | South African Depression and Anxiety Group | www.sadag.org | 0800 567 567 |

| South Korea | 중앙자살예방센터[Korea Suicide Prevention Center] | www.spckorea.or | 1393 |

| Spain | Teléfono de la Esperanza | www.telefonodelaesperanza.org | 717 003 717 |

| Switzerland | Die Dargebotene Hand | www.143.ch | 143 |

| Taiwan | 国际生命线台湾总会 [International Lifeline Taiwan Association] | www.life1995.org | 1995 |

| Ukraine | Lifeline Ukraine | lifelineukraine.com | 7333 |

| United Kingdom | Samaritans | www.samaritans.org/how-we-can-help | 116 123 |

| United States | 988 Suicide & Crisis Lifeline | 988lifeline.org | 988 |

Departmentalized Accounting Class

Hello Everyone,

The Departmentalized Accounting class starts on Tuesday, October 18, 2022 at 6:00 PM. The end time will be at approximately 9:00 PM.

The Zoom information and URL to attend the class is:

Steve Windham is inviting you to a scheduled Zoom meeting.

Topic: Departmentalized Accounting

Time: Oct 18, 2022 06:00 PM Pacific Time (US and Canada)

Every week on Tue, 16 occurrence(s):

Oct 18, 2022 6:00 PM

Orientation.

(Contact Hours = 1.00 Hour. Students = ARM)

Oct 25, 2022 6:00 PM

Cancelled--Students waiting on books.

Nov 01, 2022 6:00 PM

Cancelled--Student sick.

Nov 08, 2022 6:00 PM

Cancelled--Student sick.

Nov 15, 2022 6:00 PM

Cancelled--Steve business trip.

Nov 22, 2022 6:00 PM

Reviewed Lesson 1-1 and 1-2, including: ETHICS IN ACTION--Page 6, FORENSIC ACCOUNTING--Page 10 (Excel File), and GLOBAL AWARENESS--Page 18; Working Papers pages 1, 2, 3, 5, & 6.

(Contact Hours = 3.00 Hours. Students = AR)

Nov 29, 2022 6:00 PM

Working Papers pages 7, 8, 9,10, 11, & 12. Reviewed Lesson 1-3, including: WHY ACCOUNTING--Page 20 and EXPLORE ACCOUNTING--Page 30.

(Contact Hours = 3.00 Hours. Students = ARM)

Dec 06, 2022 6:00 PM

Reviewed remainder of Lesson 1-3. Where's my missing dollar problem; Working Papers pages 13, 14, 15, 16, 17, & 18. Review next week's lesson.

(Contact Hours = 3.00 Hours. Students = ARM)

Dec 13, 2022 6:00 PM

Multiple people sick--class cancelled.

Dec 20, 2022 06:00 PM

Christmas break--no class.

Dec 27, 2022 6:00 PM

Textbook 1-1 Application Problem, Page 31 (Working Papers Page 19), Textbook 1-C Challenge Problem, Page 33 (Working Papers Page 31), Textbook Auditing for Errors, Page 35 (click here for spreadsheet).

(Contact Hours = 2.00 Hours. Students = ARM)

Jan 03, 2023 6:00 PM

Textbook, Pages 36-45. Discuss: Ethics in Action, Page 39 and Financial Literacy, Page 44. Working Papers -- Study Guide 2, Pages 43-45.

(Contact Hours = 3.00 Hours. Students = ARM)

Jan 10, 2023 6:00 PM

Class cancelled -- S sick.

Jan 17, 2023 6:00 PM

Textbook 2-1 Work Together, Page 46 (Working Papers Pages 47-49).

(Contact Hours = 2.00 Hours. Students = RM)

Jan 24, 2023 6:00 PM

Class cancelled -- R in Hawaii.

Jan 31, 2023 6:00 PM

Textbook, finish 2-2, including Chapter Summary, Page 57, Explore Accounting, Transfer Pricing, Page 57, and 21st Century Skills, Page 61.

Textbook 2-1 On Your Own, Page 46 (Working Papers, Pages 50-52).

(Contact Hours = 3.00 Hours. Students = ARM)

February 06, 2023 6:00 PM

Discuss prior week work.

(Contact Hours = 0.75 Hours. Students = ARM)

February 13, 2023 6:00 PM

No class.

February 20, 2023 6:00 PM

Rescheduled for February 21, 2023 6:00PM because Steve was travelling.

February 21, 2023 6:00 PM

Class cancelled -- one of the students was sick.

February 27, 2023 6:00 PM

Review 3-1 (Pages 64-65); Ethics in Action (Page 64); and Global Awareness (Page 65).

Short class due to tax season.

(Contact Hours = 1.00 Hours. Students = ARM)

March 06, 2023 6:00 PM

No class.

March 13, 2023 6:00 PM

Review 3-1 (Pages 66-73); Forensic Accounting (Page 72).

Crazy Eddie Videos on youtube.com.

Audit your understanding (Page 74).

Work Together 3-1, Page 74 (Pages 89-90 in Working Papers).

On Your Own 3-1, Page 74 (Pages 91-92 in Working Papers).

(Contact Hours = 3.00 Hours. Students = ARM)

March 20, 2023 6:00 PM

Review 3-2 (Pages 76-82).

Audit your understanding (Page 83).

Why Accounting? "Executive Compensation" (Page 82).

Audit your understanding (Page 82).

Work together 3-2, Page 83 (Pages 93-94 in Working Papers).

On your own, Page 83 (Pages 95-96)... Started, but did not complete.

(Contact Hours = 3.00 Hours. Students = ARM)

March 27, 2023 6:00 PM

Class cancelled -- Steve had COVID.

April 03, 2023 6:00 PM

Class Cancelled -- Steve had COVID.

April 10, 2023 6:00 PM

Class Cancelled -- Steve had COVID.

April 17, 2023 6:00 PM

Class Cancelled -- Tax Season Deadline on 04/18/2023.

April 24, 2023 6:00 PM

Class Cancelled -- Multiple people unable to attend.

May 01, 2023 6:00 PM

On your own, Page 83 (Pages 95-96). Answer key emailed to students.

Explore Accounting (Page 86).

Ethics in Action (Page 96).

Financial Literacy (Page 104).

Careers in Accounting (Page 105).

Review Lesson 4-1.

Audit your understanding (Page 107).

(Contact Hours = 2.35 Hours. Students = AR)

May 08, 2023 6:00 PM

4-1 Work Together, Page 107 (textbook) and Pages 121-126 (working papers).

DEPT ACCT 05.08.2023 4-1 WORK TOGETHER

(Contact Hours = 2.40 Hours. Students = AR)

May 15, 2023 6:00 PM

Class Cancelled -- Multiple people unable to attend.

May 22, 2023 6:00 PM

Class Cancelled -- Steve unable to attend.

May 29, 2023 6:00 PM

Memorial Day Holiday -- No Class.

June 05, 2023 6:00 PM

Review Lesson 4-2.

Audit your understanding (Page 111).

Work together 4-2 (Kitchen Department -- work together, Bath Department -- work alone).

Skip On your own 4-2.

Review: Why Accounting? Accounting for Engineers (Page 118).

Review: Think Like An Accountant. Allocating Corporate Expenses (Page 119). Discuss Dave Ramsey $150 million timeshare lawsuit.

Review: Explore Accounting. Exception Reports (Page 126).

(Contact Hours = 2.70 Hours. Students = ARM).

June 12, 2023 6:00 PM

Class cancelled by Steve.

June 19, 2023 6:00 PM

Class cancelled by Steve.

June 26, 2023 6:00 PM

Review Lesson 4-3.

Audit your understanding (Page 116).

Work Together 4-3 (Preparing financial statements).

Work Together 4-3; Page 116 -- Answer Key (pdf).

(Contact Hours = 2.33 Hours. Students = AR).

**Class will be held on Thursday, June 29 and Thursday, July 06.**

June 29, 2023 6:00 PM

Review Lesson 4-3 to reinforce concepts.

Review Lesson 4-4.

WHY ACCOUNTING? -- Accounting for Engineers, Page 118.

Summary of the Accounting Cycle, Page 121.

Audit your understanding, Page 122.

Chapter Summary, Page 126.

Work together, Textbook Page 122; Working Papers Page 145.

(Contact Hours = 3.00 Hours. Students = ARM).

July 06, 2023 6:00 PM

Class cancelled.

July 10, 2023 6:00 PM

Class cancelled.

July 18, 2023 6:00 PM

Review APPENDIX: Preparing a Work Sheet, Textbook Pages 132-133.

Start Reinforcement Activity 1, Processing and Reporting Departmentalized Accounting Data, Textbook Pages 135-138; Working Papers Pages 187-219.

(Contact Hours = 2.00 Hours. Students = ARM).

Contact Hours are based on the AICPA and IRS C(P)E 50-minute contact hours. Note: Windham Solutions is not registered as a C(P)E provider with the AICPA or the IRS. Their guidelines are simply used for calculating contact hours.

Please download and import the following iCalendar (.ics) files to your calendar system.

Weekly: https://us06web.zoom.us/meeting/tZYldO2trj0uG9Q6okAHOfDPVu3yuDthlTGI/ics?icsToken=98tyKuGqpjguH9STtBiHRpwQGojCLO_ziCFbjfpsyhDuIgh8ZCfGAPcRK6dbBNDc

Join Zoom Meeting

https://us06web.zoom.us/j/82834506410?pwd=RmcvcXpQbG8wK2xtR1pFdENiWjNUUT09

Meeting ID: 828 3450 6410

Passcode: 685647

One tap mobile

+16694449171,,82834506410#,,,,*685647# US

+17193594580,,82834506410#,,,,*685647# US

Dial by your location

+1 669 444 9171 US

+1 719 359 4580 US

+1 720 707 2699 US (Denver)

+1 253 215 8782 US (Tacoma)

+1 346 248 7799 US (Houston)

+1 646 558 8656 US (New York)

+1 646 931 3860 US

+1 301 715 8592 US (Washington DC)

+1 309 205 3325 US

+1 312 626 6799 US (Chicago)

+1 360 209 5623 US

+1 386 347 5053 US

+1 564 217 2000 US

Meeting ID: 828 3450 6410

Passcode: 685647

Find your local number: https://us06web.zoom.us/u/kjHZpbqF

See you soon!

Steve M. Windham

California Middle Class Tax Refunds

The Internal Revenue Service, on February 10, 2023, has issued guidance on state tax payments to help taxpayers:

The Internal Revenue Service, on February 10, 2023, has issued guidance on state tax payments to help taxpayers:

WASHINGTON — The Internal Revenue Service provided details today clarifying the federal tax status involving special payments made by 21 states in 2022.

The IRS has determined that in the interest of sound tax administration and other factors, taxpayers in many states will not need to report these payments on their 2022 tax returns.

During a review, the IRS determined it will not challenge the taxability of payments related to general welfare and disaster relief. This means that people in the following states do not need to report these state payments on their 2022 tax return: California, Colorado, Connecticut, Delaware, Florida, Hawaii, Idaho, Illinois, Indiana, Maine, New Jersey, New Mexico, New York, Oregon, Pennsylvania and Rhode Island. Alaska is in this group as well, but please see below for more nuanced information.

Click here to view the complete News Release on the IRS website.

The California Franchise Tax Board has issues significant guidance on the California Middle Class Tax Refunds.

Concerning offsets/withholding:

- The Middle Class Tax Refund payment is not taxable for California state income tax purposes.

- The Middle Class Tax Refund payment will not be subject to offset for debts owed to Franchise Tax Board or other government agencies.

- The Middle Class Tax Refund payments are not subject to garnishment orders, with the exception of orders in connection with child support, spousal support, family support, or a criminal restitution payable to victims. If you believe your Middle Class Tax Refund payment that was deposited with your financial institution has been levied/frozen in error, please contact the phone number provided by your financial institution.

January 23, 2023 — IRS Official Start Date for the 2023 Tax Filing Season

The Internal Revenue Service has announced that January 23, 2023 will be the official start date of the 2023 tax filing season. This is the first date that the IRS will be processing 2022 tax returns. The deadline this year is April 18, 2023, as per the IRS website:

The Internal Revenue Service has announced that January 23, 2023 will be the official start date of the 2023 tax filing season. This is the first date that the IRS will be processing 2022 tax returns. The deadline this year is April 18, 2023, as per the IRS website:

The filing deadline to submit 2022 tax returns or an extension to file and pay tax owed is Tuesday, April 18, 2023, for most taxpayers. By law, Washington, D.C., holidays impact tax deadlines for everyone in the same way as federal holidays. The due date is April 18, instead of April 15, because of the weekend and the District of Columbia's Emancipation Day holiday, which falls on Monday, April 17.

Taxpayers requesting an extension will have until Monday, October 16, 2023, to file.

This year, taxpayers and tax professionals should see improved service and processing times. This is due to the passage of the Inflation Reduction Act, which has resulted in the IRS hiring more than 5,000 new telephone assistors, as well as more in-person staff to provide support to taxpayers.

Accounting as a STEM Major

Accounting is in the process of becoming a STEM major. Many colleges and universities have certified Accounting as STEM majors. Furthermore, there is Federal legislation that, if passed, will result in Accounting being a STEM subject for K-12. For more info, click on the link below.

Introduced in House (06/11/2021)

Accounting STEM Pursuit Act of 2021

The American Institute of Certified Public Accountants (AICPA) is also very interested in Accounting becoming a STEM subject. Click here to read the AICPA's "NOMINATION OF ACCOUNTING AND RELATED CIP CODES FOR INCLUSION IN DHS STEM DESIGNATED DEGREE PROGRAM LIST."

I have made a video that discusses this and other issues relating to Accounting as a major and profession. The video can be found here.

I now teach at the Vacaville Adult School… again!

Updated on Saturday, March 18, 2023.

This class was cancelled on March 07, 2023, as the administration and I were unable to come to an agreement over several issues. As such, this course has been cancelled and no further class meetings will be held. At present, I am no longer affiliated with the Vacaville Adult School and/or the Muzetta Thrower Adult Education Center. I remain a credentialed educator in good standing with the California Commission on Teacher Credentialing.

If you are interested in taking this course directly through me, please contact me. Tentatively, I will be teaching Accounting I online, in real-time, using Zoom starting sometime around May or June 2023.

My first actual teaching job as teacher of record was at the Vacaville Adult School where I taught High School Diploma Independent Study and Digital Photography. I am back at the Vacaville Adult School teaching Accounting at the Muzetta Thrower Adult Education Center. I am very much looking forward to teaching in Vacaville again! The start date for my course is February 09, 2023.

Here is a link to my current course:

https://go.asapconnected.com/?org=4848#CourseID=280857

I now teach at the University of Idaho!

Commencing in January 2023, I will be teaching Accounting part-time, online at the University of Idaho in the Accounting & MIS Department of the College of Business and Economics. If anyone is looking to obtain a Bachelor in Business Administration degree, the University of Idaho now offers an Online Bachelor of Business Administration Degree, as well as several Online Business Certificates. The College of Business and Economics Online Education page can be found here: https://www.uidaho.edu/cbe/distance-education.

University of Idaho students -- Click here for my teacher page.

If you are a client and are wondering if I am still going to be offering my accounting and tax services, the answer is: Yes! For the most part, everything will be business as usual. The only caveat is that I am doing more work online and meeting less with clients in person. If, however, your situation necessitates that we meet in person, this can be arranged. For more information, please visit: https://windhamsolutions.com/year-end-2022-update/ or call me at: 707-65-3325.

RIP José Juan Nevárez Ontiveros

Merry Christmas & Happy Holidays

Occupy UC Davis 2011

Protester at "Occupy UC Davis" in 2011.

.

.

Today, Monday, November 21, 2022, Facebook reminded me that it has been eleven years since the UC Davis pepper spray incident where the UC Davis Police violently and maliciously pepper sprayed several non-violent students.

.

.

To view my portfolio of photographs from the protest, please visit: https://www.stevewindham.com/portfolio/photojournalism/occupy-uc-davis-2011/

.

.

To learn more about the UC Davis pepper spray event and scandal, please visit: https://en.wikipedia.org/wiki/UC_Davis_pepper_spray_incident

Federal Student Loan Debt Relief

Updated on November 14, 2022

As per the US Government website:

Student Loan Debt Relief Is Blocked

https://dockets.justia.com/docket/texas/txndce/4:2022cv00908/368635

See also:

https://www.courtlistener.com/docket/65385675/state-of-nebraska-v-biden/

If you have a Federal student loan, you are encouraged to apply for the "Federal Student Loan Debt Relief."

As per the US Government website, "Application is open, but debt discharge is paused. As a result of a court order, we are temporarily blocked from processing debt discharges. We encourage you to apply if you are eligible. We will continue to review applications. We will quickly process discharges when we are able to do so and you will not need to reapply."

.

The status of the debt relief program is fluid and uncertain, but you are encouraged to apply. The deadline is December 31, 2023. Follow the link below to apply:

CALIFORNIA Taxpayers — The Middle Class Tax Refund

California Taxpayers, you may qualify for the California Middle Class Tax Refund. This refund is being paid to a large group of California taxpayers with payments being sent out between October 2022 and January 2023.

For more information, please visit:

I do not have any further information regarding distributions. If you have any further questions, you will have to contact the California Franchise Tax Board.

Accounting Certifications & Licenses

Several students have inquired as to what different accounting licenses and certifications are available and what they can do for you professionally. There are several different types of licenses and certifications available to the accounting professional. Certain credentials, such as the PTIN, are required to do certain types of tax work. Other credentials, such as the ERO and FINCen BSA E-Filing Account are required to e-file different types of tax returns. Credentials such as the CTEC, EA, CPA, and a law license are required to legally perform certain types of work. Yet, other credentials, show that the credential holder has a certain degree of knowledge, such as the CMA. This list is not exhaustive, but it is a starting point.

Tax Professional Certifications, Credentials, Licenses, and Other (Federal Level):

- IRS Acceptance Agent and Certified Acceptance Agent -- Required for those who wish to process IRS Forms W-7 for the Individual Tax Identification Numbers.

https://www.irs.gov/individuals/international-taxpayers/acceptance-agent-program

. - IRS Annual Filing Season Program -- Non-credentialed return preparers who aspire to a higher level of professionalism.

https://www.irs.gov/tax-professionals/annual-filing-season-program

. - IRS Centralized Authorization File (CAF) -- Used by the IRS to store Powers of Attorney and other documents that allow the tax practitioner to access taxpayer records.

https://www.irs.gov/businesses/small-businesses-self-employed/the-centralized-authorization-file-caf-authorization-rules

. - IRS Enrolled Agent -- The highest credential awarded by the Internal Revenue Service that grants unlimited practice rights before the Internal Revenue Service.

https://www.irs.gov/tax-professionals/enrolled-agents/enrolled-agent-information

. - IRS Employer Identification Number (EIN) -- Required if you form an entity.

https://www.irs.gov/businesses/small-businesses-self-employed/employer-id-numbers

. - IRS ERO (Electronic Return Originator) -- Required to e-file federal tax returns.

https://www.irs.gov/e-file-providers/become-an-authorized-e-file-provider

. - IRS E-Services Account -- E-Services that are offered only to tax professionals.

https://www.irs.gov/e-services

. - IRS PTIN (Preparer Tax Identification Number) -- Required to sign tax returns and engage in other tax work.

https://www.irs.gov/tax-professionals/ptin-application-checklist-what-you-need-to-get-started

. - US Tax Court (Attorney and Non-Attorney Practitioners) -- For those who wish to represent clients before the United States Tax Court.

https://www.ustaxcourt.gov/practitioners.html

.

- US Treasury Financial Crime Enforcement Network Bank Secrecy Act E-Filing System -- For those who need to file FBARs.

https://bsaefiling.fincen.treas.gov/main.html

Certified Public Accountant (CPA) License

- American Institute of Certified Public Accountants (AICPA)

- National Association of State Boards of Accountancy (NASBA)

. - State Boards of Accountancy and Licensing Boards for CPAs:

- Alabama State Board of Public Accountancy

- Alaska Board of Public Accountancy

- Arizona State Board of Accountancy

- Arkansas State Board of Public Accountancy

- California Board of Accountancy

- Colorado Board of Accountancy

- Connecticut State Board of Accountancy

- Delaware Board of Accountancy

- Florida Division of Certified Public Accounting

- Georgia State Board of Accountancy

- Hawaii Board of Public Accountancy

- Idaho State Board of Accountancy

- Illinois Board of Examiners

- Indiana Professional Licensing Agency

- Iowa Professional Licensing and Regulation Bureau

- Kansas Board of Accountancy

- Kentucky Board of Accountancy

- Louisiana State Board of Certified Public Accountants of Louisiana

- Maine Board of Accountancy

- Maryland Board of Public Accountancy

- Massachusetts Board of Public Accountancy

- Michigan Board of Accountancy

- Minnesota Board of Accountancy

- Mississippi State Board of Public Accountancy

- Missouri Board of Accountancy

- Montana Board of Public Accountants

- Nebraska Board of Public Accountancy

- Nevada State Board of Accountancy

- New Hampshire Board of Accountancy

- New Jersey State Board of Accountancy

- New Mexico Public Accountancy Board (NMPAB)

- New York State Board for Public Accountancy

- North Carolina State Board of Certified Public Accountant Examiners

- North Dakota Board of Accountancy

- Ohio Accountancy Board of Ohio

- Oklahoma Accountancy Board

- Oregon Board of Accountancy

- Pennsylvania State Board of Accountancy

- Rhode Island Board of Accountancy

- South Carolina Board of Accountancy

- South Dakota Board of Accountancy

- Tennessee State Board of Accountancy

- Texas State Board of Public Accountancy

- Utah Division of Occupational and Professional Licensing--Accountancy

- Vermont Board of Public Accountancy

- Virginia Board of Accountancy

- Washington State Board of Accountancy

- West Virginia Board of Accountancy

- Wisconsin Department of Safety and Professional Services

- Wyoming Board of Certified Public Accountants

- Washington, D.C. Department of Licensing and Consumer Protection

- American Samoa Bar Association

- Commonwealth of the Northern Mariana Islands (NASBA)

- Guam Board of Accountancy

- Puerto Rico Departamento de Estado

- U.S. Virgin Islands Board of Public Accountancy

State-Level Tax Preparer Licensing Bodies

- California -- California Tax Education Council (CTEC)

- Connecticut -- Paid Preparers and Facilitators

- Illinois -- Public Act 099-0641

- Maryland -- Board of Individual Tax Preparers

- New York -- Tax Preparer and Facilitator Registration

- Oregon -- Oregon Board of Tax Practitioners

Miscellaneous Accounting and Accounting-Related Certifications

- Certified Bookkeeper -- American Institute of Professional Bookkeepers (AIPB)

- Certified Financial Analyst

- Certified Financial Crime Specialists -- Various Certifications

- Certified Financial Planner

- Certified Fraud Examiner

- Certified Internal Auditor

- Certified Management Accountant & Certified in Strategy and Competitive Analysis

- Certified Treasury Professional

- Chartered Accountant (England & Wales)

- National Association of Certified Public Bookkeepers (NACPB) -- Various Accounting Certifications

Recommended Study Guides

Advanced Accounting — Departmentalized Accounting Course

Advanced Accounting -- Departmentalized Accounting Course

Start Date: Tuesday, October 18, 2022

Frequency: Every Tuesday (except holidays) for approximately three months. Three (3) hour meetings.

Location: Zoom

For more information, please visit:

ADVANCED ACCOUNTING — DEPARTMENTALIZED ACCOUNTING COURSE RESOURCES LIBRARY

Kiplinger Article on Maximizing Social Security Benefits

Social Security can be a tricky topic, and many people have many misunderstandings on how it actually works. When considering how to maximize Social Security Survivor Benefits for a spouse, there are several factors that must be taken into consideration. Kiplinger has a great article that explains in detail what you need to know if you need to maximize Social Security Survivor Benefits.

Click here to link to the article.

Certified Bookkeeper Sequence of Courses

I will be offering a sequence of courses that lead to the American Institute of Professional Bookkeeper's Certified Bookkeeper Designation.

Accounting Systems — Final Stretch

Accounting Systems Students,

Class is cancelled for Wednesday, August 04, 2021, and will resume on Wednesday, August 11, 2021. We should be able to complete this course within the next few weeks. Keep up the good work, we are getting close!

Class meeting information, online via Zoom.

Steve Windham is inviting you to a scheduled Zoom meeting.

Topic: Accounting Systems

Time: 06:00 PM Pacific Time (US and Canada)

Every week on Monday's.

Join Zoom Meeting

https://zoom.us/j/97673985504

Meeting ID: 976 7398 5504

One tap mobile

+16699009128,,97673985504# US (San Jose)

+12532158782,,97673985504# US (Tacoma)

Dial by your location

+1 669 900 9128 US (San Jose)

+1 253 215 8782 US (Tacoma)

+1 346 248 7799 US (Houston)

+1 301 715 8592 US (Germantown)

+1 312 626 6799 US (Chicago)

+1 646 558 8656 US (New York)

Meeting ID: 976 7398 5504

Find your local number: https://zoom.us/u/aeoPMcAQJ4

Topic: Accounting Systems, Week 1

Time: 06:00 PM Pacific Time (US and Canada)

The virtual meeting will open at 5:45PM; class starts at 6:00PM and concludes at 9:00PM.

Study materials and information for the Accounting Systems class can be found below:

*If any of you have difficulties logging in, feel free to call me at: 707-635-3325.

I am looking forward to seeing you soon!

Steve M. Windham

Fill Your Days!

Fill Your Days! This is my advice to people. I have been saying it for quite some time.

Nobody knows how long they are going to live, but yet, so many people waste time... not just moments of time, but sometimes days, weeks, and even longer!

When you are on your deathbed, no amount of money will add any significant, quality of life, time to your life.

Carpe Diem! Seize the day! Quit procrastinating! Do something meaningful!

This weekend, this was in my fortune cookie:

While nobody knows just how long they are going to live, it is always interesting to check your life expectancy on the Social Security, Actuarial Life Table.

Carpe Diem, and fill your days, my friends!

January 2021 Economic Impact Payments

If you have not yet received your January 2021 Economic Impact Payment, you can check the status at the link below:

https://sa.www4.irs.gov/irfof-wmsp/login

More information is available the the link below:

https://www.irs.gov/coronavirus/get-my-payment

NOTE:

If you have not yet received your payment, all I can do is advise you to wait. I have no access to additional information, and the IRS does not have any additional information beyond what's available on their website. Unfortunately, many people have yet to receive their payments. There is nothing you can do at this point, but to wait.

Tax Filing Season opens February 12, 2021

The 2021 tax filing season for Tax Year 2020 does not open until February 12, 2021. As such, I am not meeting with individual clients for tax appointments before February 12, 2021. I am; however, meeting with corporate clients, bookkeeping clients, and other business clients now so that we can finalize whatever is necessary to complete and file your business tax returns on time. Should you have any questions, please contact me. Thank you!

Digital Authentication for Courses

All courses that I have taught since I left the Fairfield-Suisun Adult School can be authenticated online. Students will receive an email with a URL directing them to their online transcript / authentication page. This URL will also be printed on the certificate. Click the link below to view the transcript / authentication page for Joe Student.

https://www.stevewindham.com/workshops-classes/authenticate/joestudent/

Accounting III — November 03, 2020 & End of Class Dinner Party on Wednesday, November 11, 2020.

Accounting III Students,

Class meeting information for November 03, 2020 at 6:00PM, online via Zoom.

Tonight is the Final Examination!

Wednesday November 11, 2020 at 6PM, we will have an end-of-class dinner party.

Restaurant: 3

Location: 721 Texas Street, Fairfield, CA 94533

URL: https://threefoodbeerwine.com/

Steve Windham is inviting you to a scheduled Zoom meeting.

Topic: Accounting III, Week 21

Time: October 27, 2020 06:00 PM Pacific Time (US and Canada)

Please use the link below to login:

Meeting ID: 969 2849 4410

One tap mobile

+16699009128,,96928494410# US (San Jose)

+12532158782,,96928494410# US (Tacoma)

Dial by your location

+1 669 900 9128 US (San Jose)

+1 253 215 8782 US (Tacoma)

+1 346 248 7799 US (Houston)

+1 312 626 6799 US (Chicago)

+1 646 558 8656 US (New York)

+1 301 715 8592 US (Germantown)

Meeting ID: 969 2849 4410

Find your local number: https://zoom.us/u/abPzuQd5JY

The virtual meeting will open at 5:45PM; class starts at 6:00PM and concludes at 9:00PM. The first few weeks will be spent making sure that everyone is able to login and access the course, as well as a review of Accounting I and Accounting II.

Study materials and information for the Accounting III class can be found below:

*If any of you have difficulties logging in, feel free to call me at: 707-635-3325.

I am looking forward to seeing you soon!

Announcement To My Fairfield-Suisun Adult School Accounting Students

Steve M. Windham

Enrolled Agent Study Materials

An Enrolled Agent is a credential awarded by the US Treasury/Internal Revenue Service that allows the credential holder to represent taxpayers before the Internal Revenue Service. The Enrolled Agent credential is the highest credential that the Internal Revenue Service Awards. For more information about the Enrolled Agent credential, please click here: https://www.irs.gov/tax-professionals/enrolled-agents

I strongly urge all of my accounting students to obtain their Enrolled Agent credentials. While the exam is rigorous, it is manageable. The exam is divided into three parts: 1) Individuals, 2) Businesses, and 3) Representation, Practices and Procedure. Section 2--Businesses, is by far the most difficult section.

My recommendation is to use the Gleim Enrolled Agent Review Course. This is the study course that I used for my Enrolled Agent exam, and I also plan to use Gleim for the CPA and CMA exams. Here is a link to the Gleim Enrolled Agent Review Courses: https://www.gleim.com/enrolled-agent-review/courses/

My recommendation is to purchase either the Traditional or Premium review systems.

.

.

Degree Completion Programs

Over the years, several of my students have inquired about degree completion programs. Many colleges and universities offer these types of programs.

My suggestion would be to go through California State University Sacramento. Sac State offers their degree completion programs through the College of Continuing Education, which while a part of the university, the College of Continuing Education has different admission requirements and fee structures. I have taken several courses at Sac State through the College of Continuing Education. Specifically, I cleared my Adult Education Teaching Credential through the Sac State College of Continuing Education, and I am working on my Certified Crime and Information Analyst Certification there as well.

Here is the link to the Sac State College of Continuing Education: https://www.cce.csus.edu/

Here is the link to the Sac State College of Continuing Education Degree Completion Programs: https://www.cce.csus.edu/degreecompletion

Here is the link to the Sac State College of Continuing Education Bachelor of Science in Career and Technical Studies Program (this degree provides the pathway to obtaining your Adult Education and Career Technical Education Teaching Credentials): https://www.cce.csus.edu/bscts

Accounting Systems Course (Revised 08/26/2020)

Hello Students!

I will be teaching an online real-time (synchronous) course on Accounting Systems. Please see the link below for more information.

Accounting III UPDATE for 08/18/2020

Hello Everyone,

I plan on holding class this evening (Tuesday, August 18, 2020); however, there may be power interruptions due to the extreme weather that we are experiencing. PG&E has been experiencing numerous power outages throughout much of California, especially the Greater San Francisco Bay Area.

In the event that we lose power, class will be rescheduled if power is not restored within fifteen (15) minutes. While I do have a backup generator, I realize that many of my students probably do not. As such, we will reschedule the class meeting in the event of a power outage that lasts more than fifteen (15) minutes. If I suddenly go offline and you do not, that means that I am likely experiencing a power outage and you are not. (I am in Vacaville, and I believe that all of you are in the Fairfield/Suisun area.) Again, please wait fifteen (15) minutes before leaving.

Thank you!

Steve M. Windham

Why I do not support the Black Lives Matter (BLM) movement (Updated: 06/25/2022).

Black Lives Matters is a cleverly trademarked phrase that has often been confused and diluted by well-intentioned people who are concerned over the plight of people of color, particularly black people, in the United States. The organization, Black Lives Matters, is not some benevolent organization that simply wants to help black people. Instead, the Black Lives Matter movement intends to disrupt the rule of law in our country, as can be evidenced by the links and videos below.

Two of their founders are "trained Marxists." (See video, below). Marxism is inconsistent with the US Constitution and the American way of life. We waged the Cold War to fight Communism, and I steadfastly refuse to support Communism, Marxism, and/or Socialism. While I acknowledge that our Republic and our Constitution do embrace some socialist concepts (e.g. progressive taxation, Social Security, etc.), there are several mechanisms in place to ensure a representative republic and a capitalistic economic framework. If standing in bread lines gets you off, move to China, Cuba, North Korea, or Venezuela. If being jailed or killed for your religion makes you happy, again, move to China, Cuba, North Korea, or Venezuela. Move there, but do not import a proven failure of a philosophical / political / economic system into the United States.

Black Lives Matters also aims to disrupt the traditional family structure. Not everyone has a family, so alternative family structures are absolutely a good thing. The problem is that this is not what Black Lives Matters aims to do. They want to distort what the vast majority of the people consider a traditional family and traditional family values.

Black Lives Matter also have embraced criminal activity, as demonstrated by their violence, rioting, and looting in several cities across the country. (See video, below.)

I am a California credentialed educator. In California, and many other states, teachers, administrators, professors, and certain other school staff are required to take an oath supporting the US Constitution, as well as the State Constitution in which the school is located.

The California oath can be found here: https://www.ctc.ca.gov/docs/default-source/educator-prep/tap/2012-10-credential-holders-responsibilities.pdf?sfvrsn=b7039f8_2.

I am going to make the argument that any educator who supports the organization, Black Lives Matters, is in violation of their oath and should be disciplined accordingly.

People often ask me to prove my position that Black Lives Matters is what I just stated above.

Here you go...

Black Lives Matter Trademarks:

Follow the link to search for the "Black Lives Matter" trademark.

BLM, What We Believe (website):

Taken directly from the BLM website:

"We disrupt the Western-prescribed nuclear family structure requirement by supporting each other as extended families and “villages” that collectively care for one another, especially our children, to the degree that mothers, parents, and children are comfortable.

We foster a queer‐affirming network. When we gather, we do so with the intention of freeing ourselves from the tight grip of heteronormative thinking, or rather, the belief that all in the world are heterosexual (unless s/he or they disclose otherwise)."

Originally found at, but is now a dead link (see UPDATE, below): https://blacklivesmatter.com/what-we-believe/

UPDATE:

Black Lives Matter has removed this from their website at some point on or about September 2020.

Using the Internet Archive WayBackMachine, we can find their old page here: https://web.archive.org/web/20200917013317/https://blacklivesmatter.com/what-we-believe/

BLM co-founder Patrisse Culors, "We are trained Marxists..." video:

Link: https://www.youtube.com/watch?v=Pyhy4IvkENg

Ariel Atkins, Chicago BLM Organizer condoning looting:

https://www.youtube.com/watch?time_continue=11&v=FfHRh98w-2U&feature=emb_logo

BLM Leader, Chanelle Helm, published her, "White people, here are 10 requests from a Black Lives Matter leader" article:

https://www.leoweekly.com/2017/08/white-people/

1. White people, if you don’t have any descendants, will your property to a black or brown family. Preferably one that lives in generational poverty.

2. White people, if you’re inheriting property you intend to sell upon acceptance, give it to a black or brown family. You’re bound to make that money in some other white privileged way.

3. If you are a developer or realty owner of multi-family housing, build a sustainable complex in a black or brown blighted neighborhood and let black and brown people live in it for free.

4. White people, if you can afford to downsize, give up the home you own to a black or brown family. Preferably a family from generational poverty.

5. White people, if any of the people you intend to leave your property to are racists assholes, change the will, and will your property to a black or brown family. Preferably a family from generational poverty.

6. White people, re-budget your monthly so you can donate to black funds for land purchasing.

7. White people, especially white women (because this is yaw specialty — Nosey Jenny and Meddling Kathy), get a racist fired. Yaw know what the fuck they be saying. You are complicit when you ignore them. Get your boss fired cause they racist too.

8. Backing up No. 7, this should be easy but all those sheetless Klan, Nazi’s and Other lil’ dick-white men will all be returning to work. Get they ass fired. Call the police even: they look suspicious.

9. OK, backing up No. 8, if any white person at your work, or as you enter in spaces and you overhear a white person praising the actions from yesterday, first, get a pic. Get their name and more info. Hell, find out where they work — Get Them Fired. But certainly address them, and, if you need to, you got hands: use them.

10. Commit to two things: Fighting white supremacy where and how you can (this doesn’t mean taking up knitting, unless you’re making scarves for black and brown kids in need), and funding black and brown people and their work.

The Founders’ Constitution

Whenever I come across a good resource for the US Constitution and US history, I like to share it with all who might be interested. Such is the case with the University of Chicago Press and Liberty Fund joint venture called “The Founders’ Constitution.”

https://press-pubs.uchicago.edu/founders/

Happy Independence Day, America!

Accounting III Start Date

Hello Everyone,

The start date for Accounting III will be Tuesday, June 09, 2020. The run time will be from 6:00PM to 9:00PM. We will meet once per week for approximately 12 to 15 weeks.

Initially, the first few meeting will be held online using Zoom. When things open up from the Coronavirus, we will move the meeting to in-person at my home in Vacaville.

Note that the first few meetings will be used to review Accounting I and II concepts, and to address technology issues, books and working papers issues, et cetera.

Please feel free to contact me if you have any questions.

Please review these posts for more information:

Announcement To My Fairfield-Suisun Adult School Accounting Students

My Coronavirus Crisis Photo Project

These are unique times in which we live. The Coronavirus Crisis has had global repercussions. The costs are measured in lives lost, lives damaged, businesses lost, and so much more!

As a photographer, I have decided to document the Coronavirus Crisis. I plan to attend as many Coronavirus Crisis protests as I can, and I am going to be working on a series of Coronavirus Masks. While my personal opinion is that most masks are ineffective, I would be very interested in photographing you in your mask and hearing your input on the topic.

Please check back frequently, as I plan on this being an ongoing project for the foreseeable future. Follow this link to my Coronavirus Crisis Photo Project.

I have also posted several photos of the Coronavirus Crisis on:

My Facebook page at: https://www.facebook.com/steve.windhamllm

My LinkedIn page at: https://www.linkedin.com/in/steve-m-windham-llm-mba-ea-8b73a07/detail/recent-activity/shares/

My Twitter page at: https://twitter.com/SMWINDHAM

Please feel free to follow and/or add me on any of these social networks!

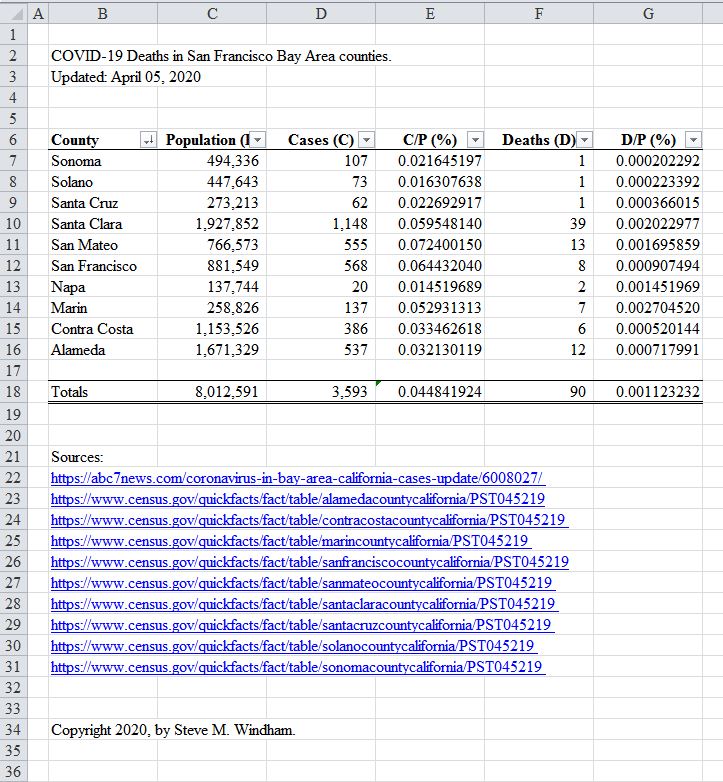

Mathematics do not lie!

MATHEMATICS DO NOT LIE!

Unfortunately, our media often times cannot be trusted. During this time of the COVID-19 crisis, the media has been PANIC PEDDLING. This irresponsible journalism is nothing short of Yellow Journalism and propaganda!

This page that I have created will show that mathematics is pure and true; whereas, the media often times is manipulative. Please visit one of these interactive spreadsheets for more information.

Last updated on April 05, 2020.

Spreadsheet Links:

Accounting III Update

Dear Students,

In light of the current COVID-19 crisis, it is highly likely that the Accounting III class will be postponed. Because this is a fluid situation, it may be best not to commit to a start date just yet.

The alternative is to maintain the start date (the week of April 19, 2020), but to conduct the class online. This would be a live class, conducted using Google Hangouts. From speaking with many of you, it seems that the majority of you prefer in-person delivery. A possibility is that we could start the class with online delivery, and then move to in-person delivery when people feel comfortable doing so.

I would greatly appreciate your input, so please get in touch with me and let me know your preferences. In the meantime, stay safe!

Thank you!

Steve M. Windham

Tel/Text: 707.635.3325

Email: [email protected]

Tax Day Extended Due to COVID-19

The Internal Revenue Service has announced that, as of March 21, 2020, the following tax deadlines have been extended:

- The Federal income tax filing due date has been automatically extended to July 15, 2020.

- The Federal income tax payment due date has also been deferred to July 15, 2020, without penalties and interest, regardless of the amount owed by the taxpayer. This deferment applies to all taxpayers, including individuals, trusts and estates, corporations and other non-corporate tax filers, as well as those who pay self-employment tax.

For more information, please visit the IRS at:

The California Franchise Tax Board has announced that, due to the COVID-19 Crisis, tax deadlines have also been extended. These extended due dates are similar to the Federal extended due dates. Please review the following pages for more information:

https://www.ftb.ca.gov/about-ftb/newsroom/covid-19/index.html?WT.ac=COVID-19

https://www.ftb.ca.gov/about-ftb/newsroom/covid-19/extensions-to-file-pay.html

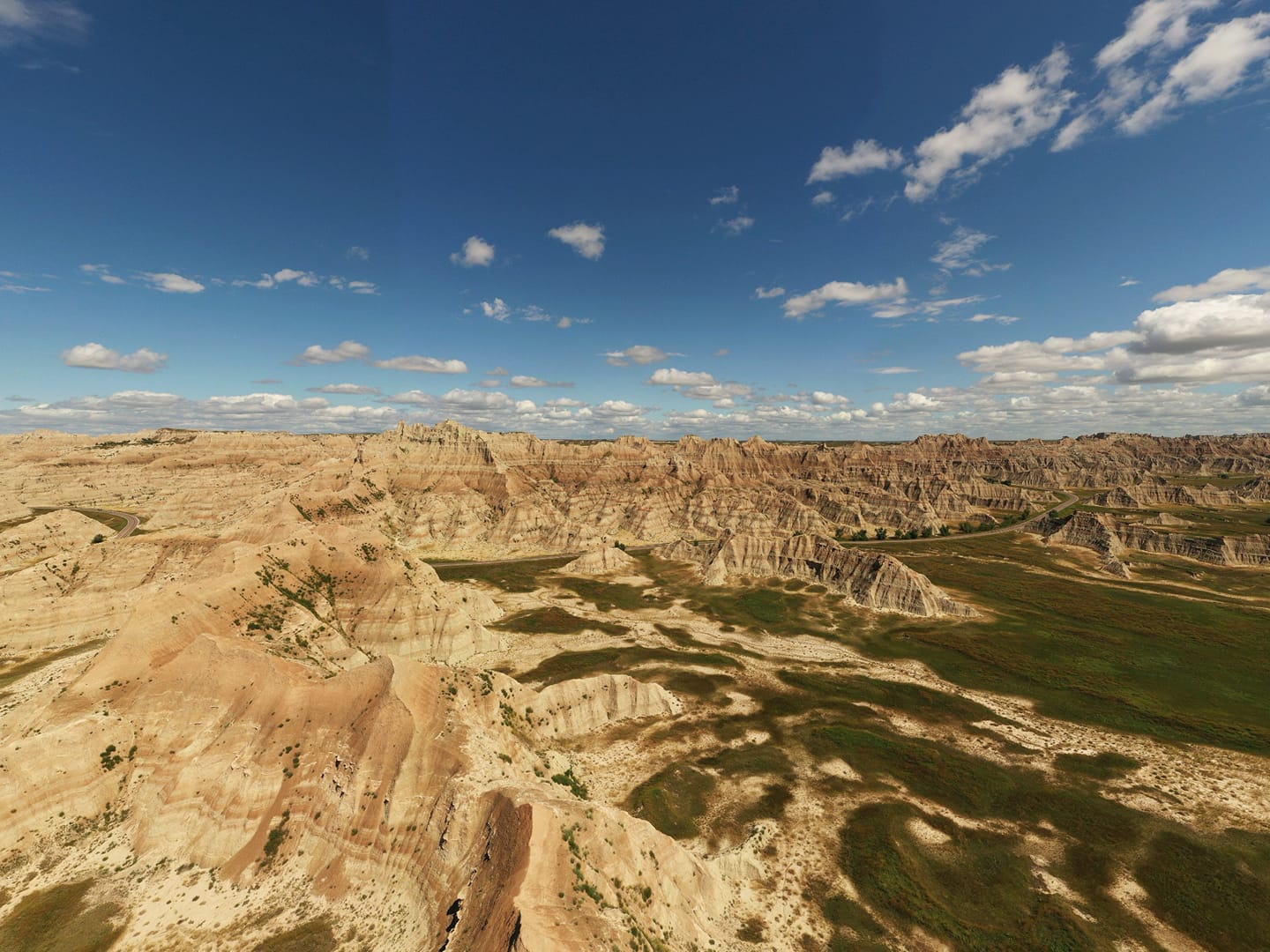

Matt Windham Photography

Matt Windham specializes in drone-based photography. Below are some samples of his work. Click on https://www.mattwindham.com to visit his website.

Interruptions due to Power Outages

DECEMBER 01, 2019 UPDATE:

The weather has changed from hot, dry, and windy to wet and cool. There have not been any PG&E Public Safety Power Shutoff (PSPS) events in my area for several weeks.

To reduce the likelihood that power outages will be an issue, I now have a backup power generator. To date, my cellular service has not been affected, which allows me to communicate via phone/text, email, and WhatsApp.

The best ways to contact me are:

1) Email: [email protected]

2) Phone/Text: 707.635.3325

3) WhatsApp: 707.635.3325

OCTOBER 21, 2019 UPDATE:

PG&E has announced there will likely be another Public Safety Power Shutoff (PSPS) for Solano County this week on Wednesday and Thursday (10/23 & 10/24). This means that I may be without power again. To date, this has not affected my cellular phone service, but a PSPS does have the potential to.

Here is the PG&E Press Release:

UPDATE:

Much of Northern California is on the PG&E list of potential Public Safety Power Shutoff areas this week. The IRS provides tax relief for those affected by disaster situations. Whether or not a Public Power Power Shutoff because of severe weather would qualify remains to be seen; however, it would seem reasonable since California is the nation's most populous state with a population of approximately 40,000,000 people.

More information on IRS Disaster Relief can be found here:

https://www.irs.gov/newsroom/tax-relief-in-disaster-situations

National Weather Service (Sacramento Office):

https://www.weather.gov/sto/

National Weather Service (Watches, Warnings, & Advisories):

https://forecast.weather.gov/wwamap/wwatxtget.php?cwa=HNX&wwa=all

PG&E Public Safety Power Shutoff map:

https://www.pge.com/en_US/safety/emergency-preparedness/natural-disaster/wildfires/psps-service-impact-map.page

PG&E Update on October 08, 2019:

https://www.pgecurrents.com/2019/10/08/pge-will-proactively-turn-off-power-for-safety-to-nearly-800000-customers-across-northern-and-central-california/

PG&E Website (with Current Alerts):

https://www.pge.com/

ORIGINAL POST (September 23, 2019):

Northern California has been issued a "Red Flag Warning" by the National Weather Service. For more information, see: https://forecast.weather.gov/wwamap/wwatxtget.php?cwa=usa&wwa=Red%20Flag%20Warning.

As a result, Pacific Gas & Electric Company is implementing "Public Safety Power Shutoff" events. Because of this, there is the possibility that power to Vacaville will be cutoff, and you may be unable to reach me. At present, Vacaville is not on the list for power shutoff, but this is a fluid situation and the situation may change. For more information, see: https://www.pge.com/en_US/safety/emergency-preparedness/natural-disaster/wildfires/public-safety-event.page.

Thank you for your patience.

Happy Constitution Day (Tuesday, September 17, 2019)

Constitution Day 2019 is Tuesday, September 17, 2019.

Celebrate what makes the United States special–the US Constitution and the Bill of Rights. While the US Constitution should be one of the most cherished documents in the world, many US schools fail to even recognize Constitution Day and many, if not most, US citizens are unaware of Constitution Day. Below are links to the US Constitution and Constitution Day. Please pass this along.

For more information, please visit:

https://www.constitutionday.com/

https://en.wikipedia.org/wiki/Constitution_Day_(United_States)

The US Constitution (Text — pdf file)

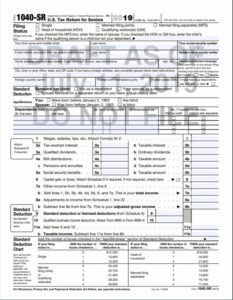

Introducing the IRS Form 1040-SR, U.S. Tax Return for Seniors

For tax year 2018, the Internal Revenue Service introduced the "postcard" 1040, along with six new schedules (to make up for chopping the Form 1040 in half). Forms 1040-A and 1040-EZ were also eliminated.

For tax year 2019, the Internal Revenue Service is introducing the Form 1040-SR, U.S. Tax Return for Seniors.

Interestingly, the old Form 1040 was largely able to accommodate everything the 1040-A, 1040-EZ, the new "postcard" 1040, and the 1040-SR could accommodate without the six additional schedules.

So while these curious new forms are somewhat interesting, they have done little, if anything, to streamline tax filing. This seems to be another case of the government fixing something that is not broken, as the Form 1040 was a finely-honed and efficient form that did an exemplary job of reporting individual income to the Internal Revenue Service.

Cryptozoology & Science

Like many people, I have an interest in cryptozoology. For those unfamiliar with the term, cryptozoology is the study of and search for cryptids, which are animals of folklore, such as Bigfoot, the Lock Ness Monster, the Chupacabra, and other unknown, mysterious creatures.

Cryptozoology is largely considered to be a pseudoscience because most adherents do not follow the scientific method. For those who need a refresher, the scientific method has six steps:

1) Purpose (What is the point of the research?)

2) Research (Conduct background research on the topic.)

3) Form a Hypothesis (Predict the outcome of the research.)

4) Experiment (Test to confirm or disprove the hypothesis.)

5) Analysis (Record and analyze–experiments are often conducted multiple times.) And,

6) Conclusion (Determine if the hypothesis was correct.)

Fortunately, there are some scientists who have applied the scientific method to cryptozoology. In 2012, Professor Bryan Sykes of Oxford University and Dr. Michel Sartori of Musee de Zoologie, Lausanne, created the Oxford-Lausanne Collateral Hominid Project. The stated purpose of the study was: “As part of a larger enquiry into the genetic relationship between our own species Homo sapiens and other hominids, we invite submissions of organic material from formally undescribed species, or ‘cryptids,’ for the purpose of their species identification by genetic means.”

While the study did not prove the existence of Bigfoot or other similar hominids, it did have some interesting findings: “Sequences derived from hair sample nos. 25025 and 25191 had a 100% match with DNA recovered from a Pleistocene fossil more than 40 000 BP of U. maritimus (polar bear) [12] but not to modern examples of the species. Hair sample no. 25025 came from an animal shot by an experienced hunter in Ladakh, India ca 40 years ago who reported that its behaviour was very different from a brown bear Ursus arctos with which he was very familiar. Hair sample no. 25191 was recovered from a high altitude (ca 3500 m) bamboo forest in Bhutan and was identified as a nest of a migyhur, the Bhutanese equivalent of the yeti. The Ladakh hairs (no. 25025) were golden-brown, whereas the hair from Bhutan (no. 25191) was reddish-brown in appearance. As the match is to a segment only 104 bp long, albeit in the very conserved 12S RNA gene, this result should be regarded as preliminary. Other than these data, nothing is currently known about the genetic affinity of Himalayan bears and although there are anecdotal reports of white bears in Central Asia and the Himalayas [13,14], it seems more likely that the two hairs reported here are from either a previously unrecognized bear species, colour variants of U. maritimus, or U. arctos/U. maritimus hybrids. Viable U. arctos/U. maritimus hybrids are known from the Admiralty, Barayanov and Chicagov (ABC) islands off the coast of Alaska though in the ABC hybrids the mitochondrial sequence homology is with modern rather than ancient polar bears [15]. If they are hybrids, the Ladakh and Bhutan specimens are probably descended from a different hybridization event during the early stages of species divergence between U. arctos and U. maritimus. Genomic sequence data are needed to decide between these alternatives. If these bears are widely distributed in the Himalayas, they may well contribute to the biological foundation of the yeti legend, especially if, as reported by the hunter who shot the Ladakh specimen, they behave more aggressively towards humans than known indigenous bear species.

With the exception of these two samples, none of the submitted and analysed hairs samples returned a sequence that could not be matched with an extant mammalian species, often a domesticate. While it is important to bear in mind that absence of evidence is not evidence of absence and this survey cannot refute the existence of anomalous primates, neither has it found any evidence in support. Rather than persisting in the view that they have been ‘rejected by science’, advocates in the cryptozoology community have more work to do in order to produce convincing evidence for anomalous primates and now have the means to do so. The techniques described here put an end to decades of ambiguity about species identification of anomalous primate samples and set a rigorous standard against which to judge any future claims.”

The full report can be read here: https://royalsocietypublishing.org/doi/full/10.1098/rspb.2014.0161

I would like to point out that new species are constantly being discovered.

- In 2012, Popular Science published this article on new species recently discovered: https://www.popsci.com/tags/new-species/

- In 2014, Business Insider published this article, claiming that 18,000 new species were discovered in 2013: https://www.businessinsider.com/top-10-new-species-of-2014-2014-5

- In 2018, EarthSky published this article, indicating that in 2017, 85 new species were discovered: https://earthsky.org/earth/85-new-species

- In 2018, treehugger published this article, documenting 10 species discovered in 2018, with one of them being a fossil discovery of an Australian marsupial lion: https://www.treehugger.com/natural-sciences/top-10-newly-discovered-species-2018.html

My advice is to: keep looking, use the scientific method, and maybe you will discover a new species. Be sure to document your findings, and remember that you will need a holotype to be placed in a museum or university to document your new species.

Marvel Comics Legend, Stan Lee, Victim of Elder Abuse and Elder Financial Abuse!

According to the police, Marvel Comics legend, Stan Lee, was a victim of elder abuse, including elder financial abuse. I am in the process of creating a course called “Elder Financial Abuse” for my Financial Crimes suite of classes that I am trying to get domiciled at a university. My “Elder Financial Abuse” class will provide students of financial crimes with tools, resources, and strategies to help detect, prevent, and stop financial elder abuse.

Click here for a news article on the elder abuse of Stan Lee.

Click here for more information on my “Elder Financial Abuse” Financial Crimes class. (Note: This class is under development and is in the beginning stages of course construction. More information, such as the syllabus, required reading, recommended reading, et cetera will be added soon!)

Retail Loss Prevention and Benefit Denial

Over the years there have been numerous physical and procedural safeguards put in place to reduce loss prevention. Thirty-five years ago, the “ink tag” was introduced to retailers. The concept is genius–attach a device to a garment that, if tampered with, will release and indelible ink onto the garment; thereby, ruining any benefit of stealing the garment.

Since most people who shoplift do so for personal use or the economic benefit of selling the item(s) on the street, this “benefit denial” approach has been shown to be quite effective. These ink tags can be tied into the merchandise inventory alarm control system, so that if the thief tries to steal the garment so they can remove the ink tag elsewhere, the alarm will trigger.

Read more about the history and evolution of the ink tag at Loss Prevention Magazine here:

My youngest son, Noah, was interviewed by CBS Sacramento about the late start time at Vacaville High School

On Tuesday, May 07, 2019, my youngest son, Noah, his girlfriend, and their friend were interviewed by CBS Sacramento about the later start time for Vacaville High School.

List of Databases–Police Accountability

LIST OF VARIOUS WEBSITES THAT TRACK POLICE KILLINGS,

POLICE VIOLENCE, POLICE DEATHS, AND POLICE MISCONDUCT:

UNITED STATES OF AMERICA:

- Cop Crisis, Americans Killed by Cops

- Fatal Encounters, Database of all deaths through police interaction in the United States since Jan. 1, 2000

- Mapping Police Violence

- Officer Down Memorial Page

- Police Violence Report

- Puppycide Database Project, Nationwide database tracking police shootings of animals

- USA Today, Police Misconduct Database

- The Washington Post, Fatal Force

CANADA:

The Puppycide Database Project

The Puppycide Database Project compiles and tracks police violence towards animals. According to the website, “[R]ecords are currently included involving cats, squirrels, birds, elephants, tigers, emu, apes and mountain lions, just to name a few.”

Obviously, sometimes it is necessary for the police to kill animals, such as when a viscous dog attacks or when dangerous animals escape from the zoo and pose an imminent threat to human life. Unfortunately, there are many instances of unwarranted and cowardly shootings of family pets by police. Many of us consider our pets to be part of the family, and it is important that police violence against animals, especially pets, is documented.

College Early Entrance Programs in the United States

Some middle and high school students may wish to consider Early Entrance Programs, some of which will allow students as young as 11 years old.

The Los Angeles Times has an informative article on the Early Entry Program, specifically about kids in the Early Entry Program at Cal State L.A. It can be found here:

The Cal State L.A. Early Entrance Program can be found here:

http://www.calstatela.edu/eep/frequently-asked-questions-faq

Johns Hopkins Center for Talented Youth has information about Early Entrance Programs throughout the country. It can be found here:

Johns Hopkins Center for Talented Youth, Early College Entrance Programs

Police Misconduct Database

For many years, I have argued that police need to be licensed like most other professions. The reality of the situation is that they are not. The exceptions are for their Driver Licenses, and when applicable their FAA Pilot Licenses (a very small percentage of police officers fall into this category). There may be various obscure licensing requirements for specialized police officers, such as FCC Radio Licenses. There is no such thing as a Police Officer License.

My reasoning behind this is that professional licenses are generally open to public inspection. Go ahead, check my licenses--all of them are available for public inspection online except for my Enrolled Agent license with the Department of the Treasury, Internal Revenue Service. They will gladly conduct a license check if you write the Office of Professional Responsibility.

Back to the police. They are not licensed. POST certification is not a license. It is a certification. While POST certification can be revoked, it is exceedingly rare. Professional licensing generally requires continuing education, accountability to a licensing authority, adherence to a code of ethics, public inspection of license, sometimes bonding and/or insurance requirement, and the ability of the licensing authority to discipline licensees. A professional license can be revoked or suspended; thereby, making it impossible to work in that profession.

The media has succeeded where the government has failed, insofar as they have created a database of police officers who have been disciplined. Unfortunately, this database does not cover all 50 states, but it is a tremendous tool that the government and the police have failed to implement on their own accord.

USA Today, along with several other media outlets, has investigated police misconduct nationwide and have released this report:

We found 85,000 cops who’ve been investigated for misconduct. Now you can read their records.

You can search their database of de-certified officers here (unfortunately California is one of the states not covered in this report):

Search the list of more than 30,000 police officers banned by 44 states.

Transparency is a wonderful thing, and because of the First Amendment we have a (mostly) free press that can be critical of the government and provide transparency and accountability when the government tries to frustrate these basic tenants of a free society.

My Resignation from the Fairfield-Suisun Adult School

Dear Students and Colleagues,

On Friday, February 15, 2019, I resigned my teaching position at the Fairfield-Suisun Adult School. My resignation was accepted by the Fairfield-Suisun Unified School District on Thursday, February 21, 2019. Without going into details, I will say that this was not a decision that I took lightly. I will miss working with my amazing students and colleagues. I plan on teaching accounting and financial crimes at another school in the not too-distant future. For those trying to access my teacher page, it has been disabled by the administrators. I have migrated some of the information from my teacher page to this website.

Steve M. Windham

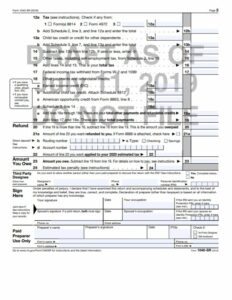

Financial Crimes Course (Fall 2019)

Hello Everyone!

I am updating the Financial Crimes survey course, and I am also trying to offer a new course called “Retail and Restaurant Loss Prevention.” As I have recently resigned my teaching position at the Fairfield-Suisun Adult School, I am looking for another school where I can domicile my Financial Crimes courses.

There is also more information for the Financial Crimes Survey course here:

If you are interested in taking this course, or my new course (currently under development), “Retail and Restaurant Loss Prevention,” please contact me.

Awareness Test

Financial Crimes Course

This fall, I will be offering an interdisciplinary survey course in Financial Crimes. Clink on the links below for more information.

FRAUDULENT caller posing as IRS (Phishing scam alert!)

Yesterday, I received a telephone call from a 305 area code (Miami). After listening to the message, I called them back. They claimed to be from the Internal Revenue Service and that I had owed a past due amount and that they were going to pursue criminal charges against me. Today, a client called me and informed me that she had received a similar call.

In both cases, these were phishing scams and not the Internal Revenue Service! I refused to give them any information, and when I informed them that they were not the IRS they hung up on me.

DO NOT give these people any information! The IRS does not call you if you owe them money. When you owe the IRS money, you will be sent numerous notices via USPS First Class Mail. It is very rare for the IRS to call a taxpayer! They nearly always use USPS First Class Mail to contact taxpayers, especially if this is an initial contact!

When in doubt, ask for their name, badge number, and a number where your accountant or attorney can call them back. Then hang up. Do not give them any personal information whatsoever over the phone–do not confirm any personal information! When in doubt about any collection proceedings from any tax authority, contact your tax professional.

Also, note that it is extremely rare (never to the best of my knowledge) for the IRS to use email when dealing with tax payers.

See the following Internal Revenue Service links below for more information:

https://www.irs.gov/newsroom/scam-phone-calls-continue-irs-identifies-five-easy-ways-to-spot-suspicious-calls

https://www.irs.gov/newsroom/phishing-schemes-lead-the-irs-dirty-dozen-list-of-tax-scams-for-2017-remain-tax-time-threat

https://www.irs.gov/privacy-disclosure/report-phishing

See the following California Franchise Tax Board links below for more information:

https://www.ftb.ca.gov/online/Fraud_Referral/index.shtml